LenDenClub swings to profit in FY25 amid stricter RBI rules

The company’s revenue rose 27.6% to Rs 236 crore, and EBITDA was Rs 50 crore, reversing a Rs 12.5 crore loss a year earlier, while net profit stood at Rs 34 crore against a Rs 14 crore loss in FY24. The management attrubited the turnaround to tighter cost controls and operational discipline.

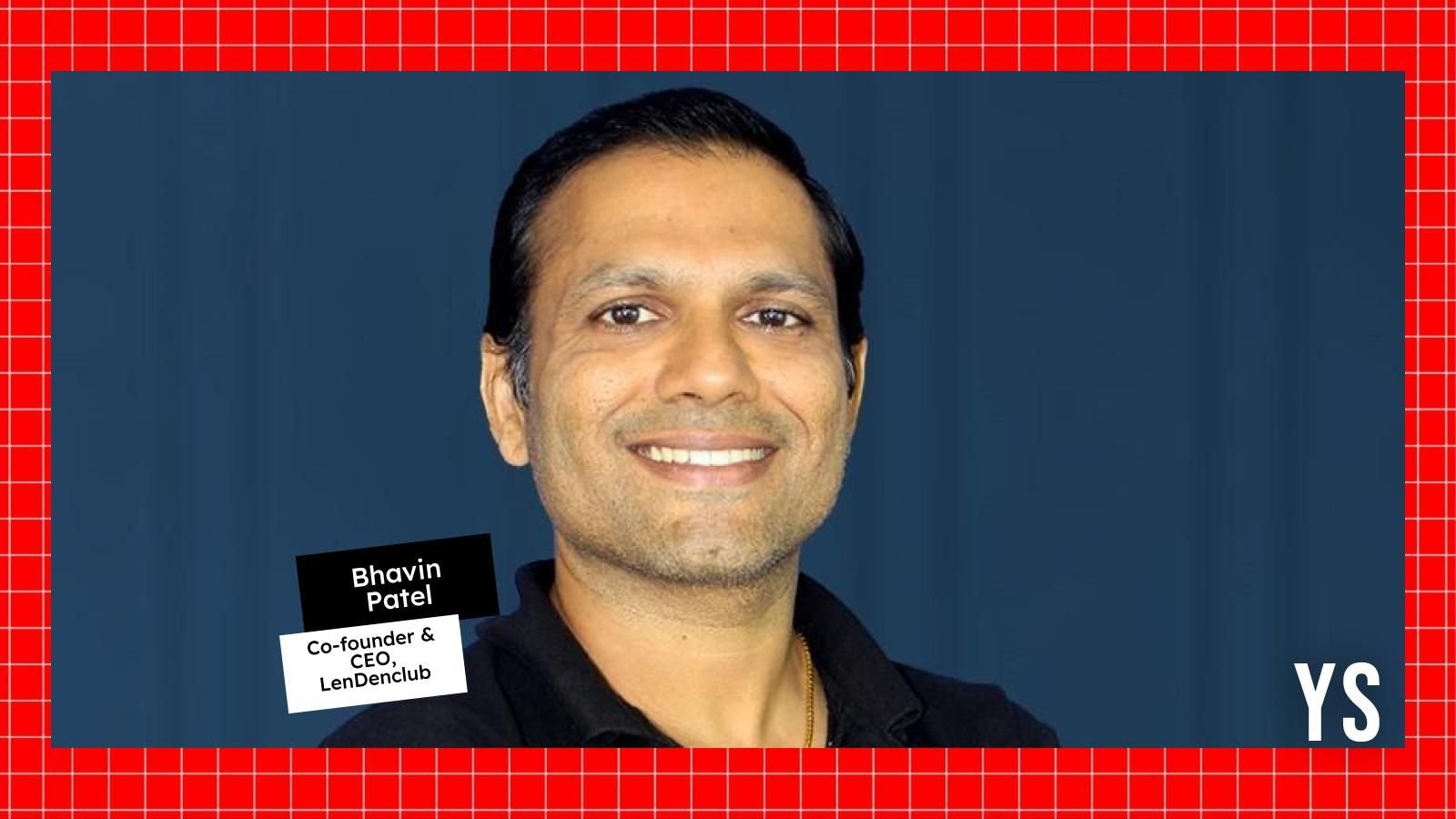

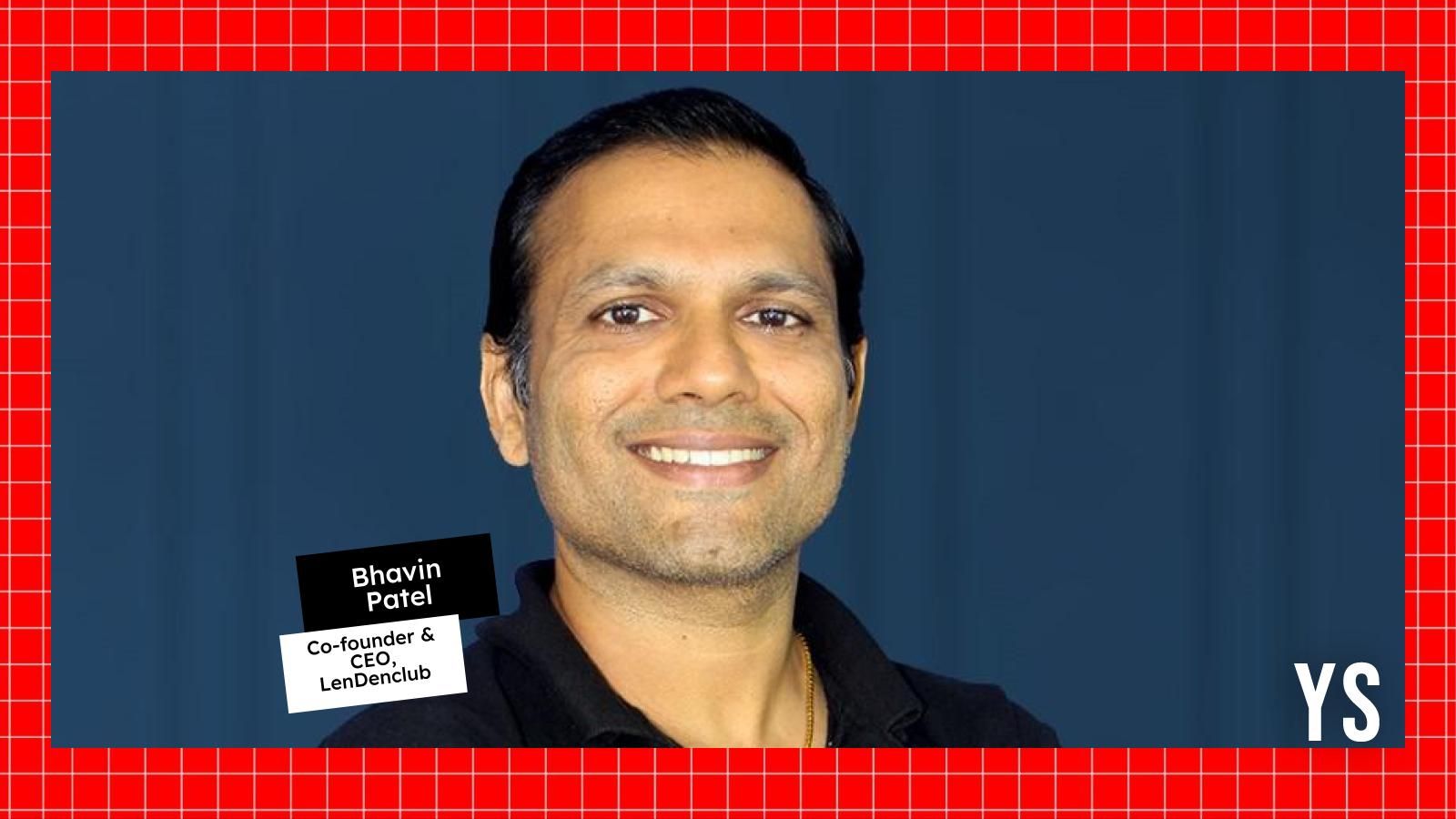

“There’s no secret—just hard work,” Co-founder and CEO Bhavin Patel said in an interview. “We take regulations positively and keep adapting until our systems align with the regulator. P2P is stabilising and is now contributing to the bottom line.”

Patel said 2023 was a reset year as LenDenClub restructured borrower categories and operations in line with regulatory guidance while undertaking a deep cost review. “We set targets—like bringing cloud cost down from around Rs 10 crore to Rs 6–7 crore over 12 months—and optimised third-party APIs across units,” he said.

These corrective measures, he said, shaped FY24’s performance and carried into FY25. “We set explicit targets—reduce cloud costs, optimise APIs—and held each unit accountable,” he said.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

LenDenClub operates three lines: its core P2P marketplace; a loan service provider(LSP) business that brings borrower demand; and a newer technology service provider(TSP) platform used by lenders.

“LSP is stable and in growth mode; P2P should reach firmer stability this year; TSP is young but already contributing revenue,” Patel said.

Disbursements have also steadied after last year’s reset. “We did about Rs 340 crore last quarter and expect Rs 450–500 crore this quarter as the lender base expands,” Patel said, noting active transacting lenders have roughly doubled in recent quarters.

NAPS (defaults) have inched up but remain “as per expectation,” broadly in the 0.5%–4% range depending on product mix and tenors, Patel said.

LenDenClub is positioning its three businesses to generate operating leverage and reduce borrowing costs. “If we keep building the ecosystem—P2P for capital, LSP for demand, TSP for rails—technology efficiencies should lower the cost of credit. Our goal is to pass on two to three percentage points to borrowers over time,” Patel said.

The RBI’s 2024 overhaul forced P2P platforms to operate strictly as marketplaces, with tighter disclosures and no risk warehousing, a shift some industry players said threatened viability. LenDenClub’s return to profitunder these rules shows how compliance-led design, diversified fee lines, and cost control can sustain the model.

Patel said supply-chain financing could sit within current rules, while secured lending remains out of scope unless regulations change. For now, the focus is on stabilising the P2P engine, scaling the LSP funnel, and growing TSP revenues, he said.

Discover more from News Hub

Subscribe to get the latest posts sent to your email.