August sees venture capital inflow of $1 billion with only 87 deals

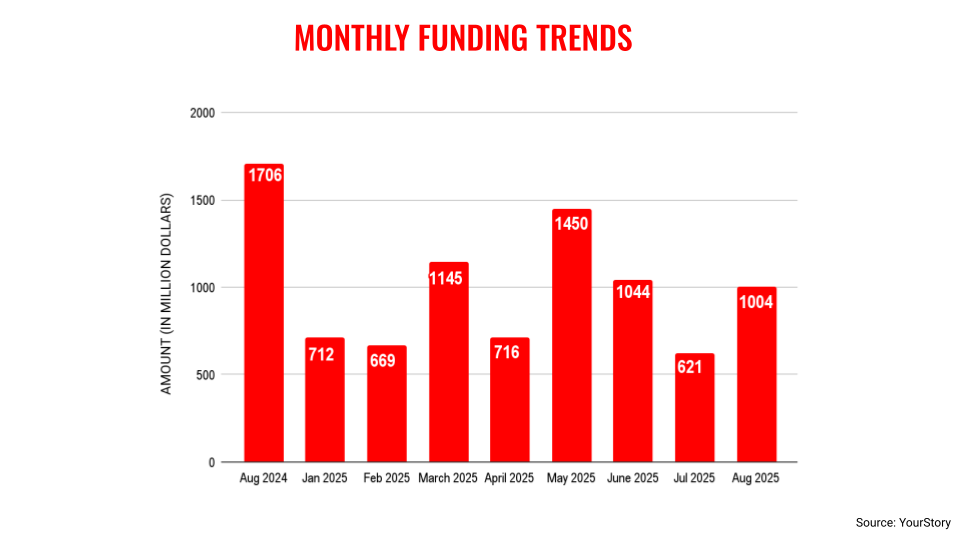

The month of August saw a total VC funding of $1 billion—a 62% rise compared to July, when the figure was just $621 million. However, on a year-over-year comparison, the VC funding was down 41% as startups had raised $1.7 billion in August 2024.

It has been a mixed bag for the Indian startup ecosystem in terms of VC inflow. On the upside, the total funding amount crossed the psychologically important mark of $1 billion in August, only the fourth time this year till now after March, May, and June.

Interestingly, the month of August saw only 87 transactions—the lowest ever for the year till now. This shows that the value per deal was higher than in any other month of the year.

The month had just a single deal with a value of more than $100 million, with Weaver Services raising $170 million. There were other notable transactions during this period, including Truemeds ($85 million), The Sleep Company ($56 million), Amnex ($52 million), Zepto ($46 million), and Darwinbox ($40 million).

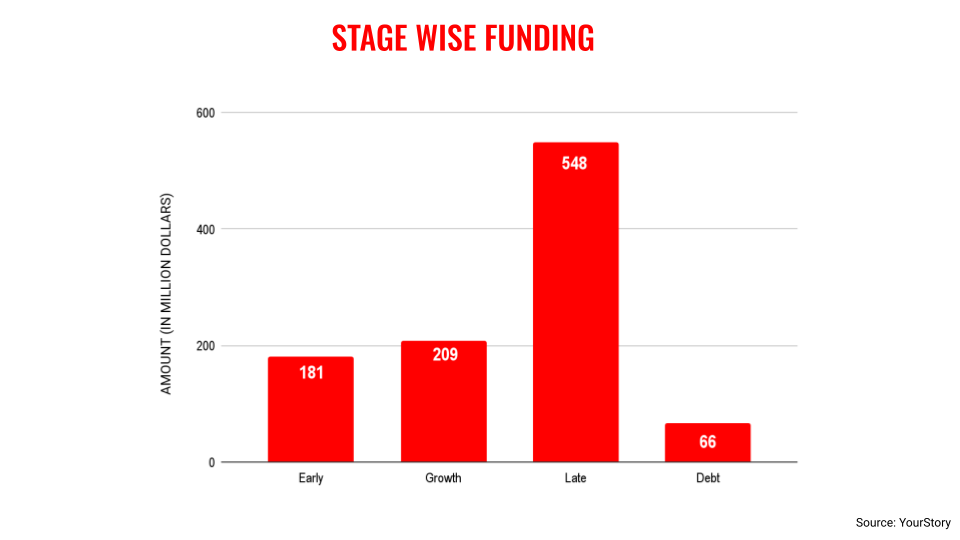

In terms of stage-wise funding, the late stage saw the highest amount raised at $548 million from only 10 deals. During the month, the venture debt category saw an inflow of $66 million, which is surprising as many startups usually take the debt route amid a slowdown in equity funding. However, the channel is yet to become a mainstream source of funding for Indian startups.

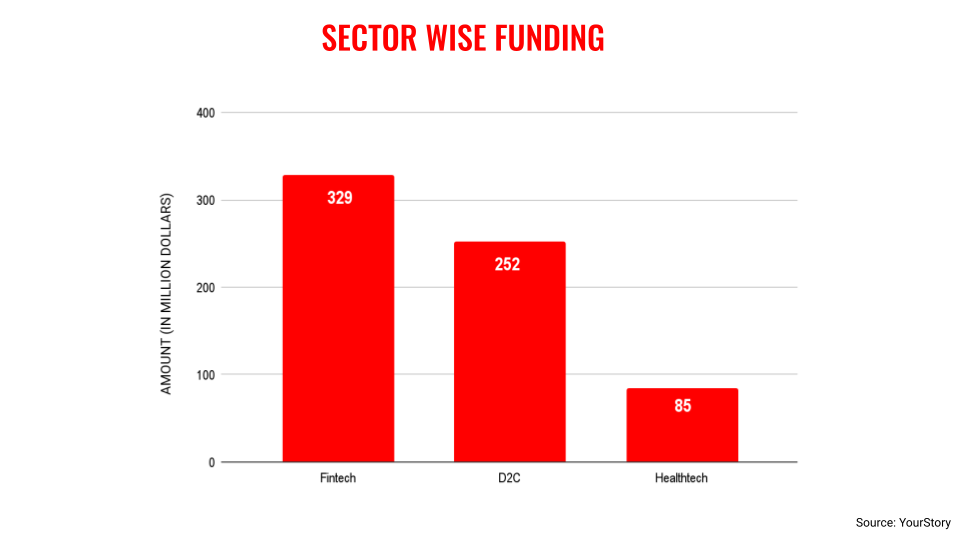

In terms of categories, the fintech segment, as usual, topped the list in August, followed by D2C and healthcare. Unfortunately, the category of artificial intelligence (AI) showed negligible fundraising during the month, which is surprising given the buzz around this segment across the world.

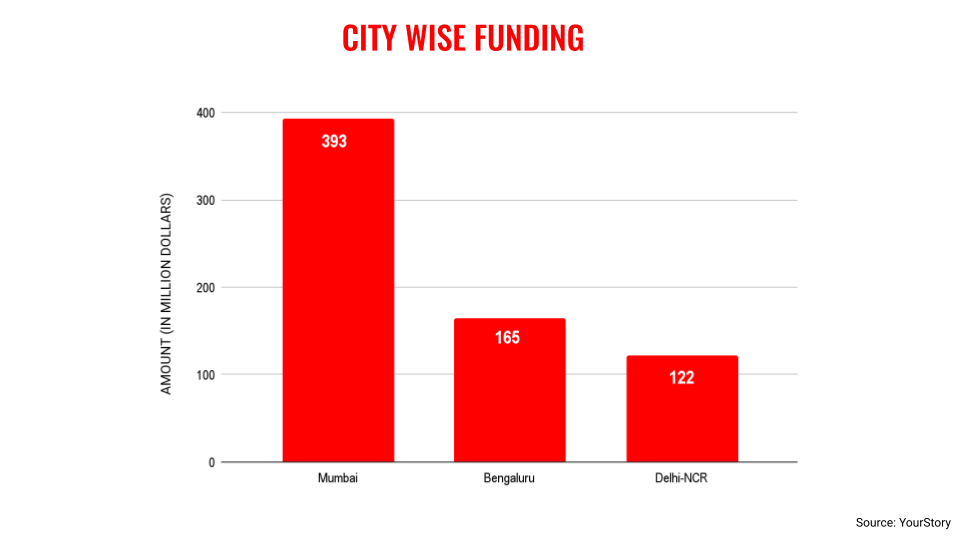

Mumbai-based startups topped the VC funding list for August, garnering $393 million, followed by Bengaluru and Delhi-NCR. These three cities have typically dominated the inflow of VC money, but this month, the metros of Ahmedabad and Hyderabad closely followed them.

The hope is that other cities in India, like Chennai, Hyderabad, and Pune, show a consistent rise in VC inflow; however, this does not seem to be the case.

Overall, while the month of August saw a VC inflow of $1 billion, this is not a cause for unbridled optimism as the startup ecosystem continues to face considerable challenges in terms of raising capital. The primary reason is the uncertain external macroeconomic conditions, which have made the investors cautious.

The hope is that the remaining months of the year will see a steady increase in VC inflow, and the final figure of 2025 will cross that of 2024.

Edited by Kanishk Singh

Discover more from News Hub

Subscribe to get the latest posts sent to your email.