[Weekly funding roundup Aug 23-29] VC inflow sees steep decline due to lack of large deals

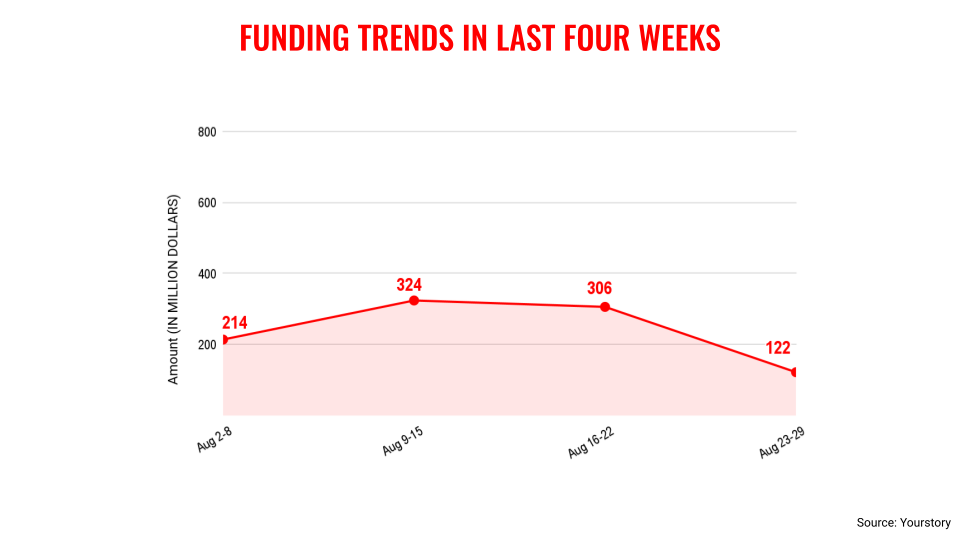

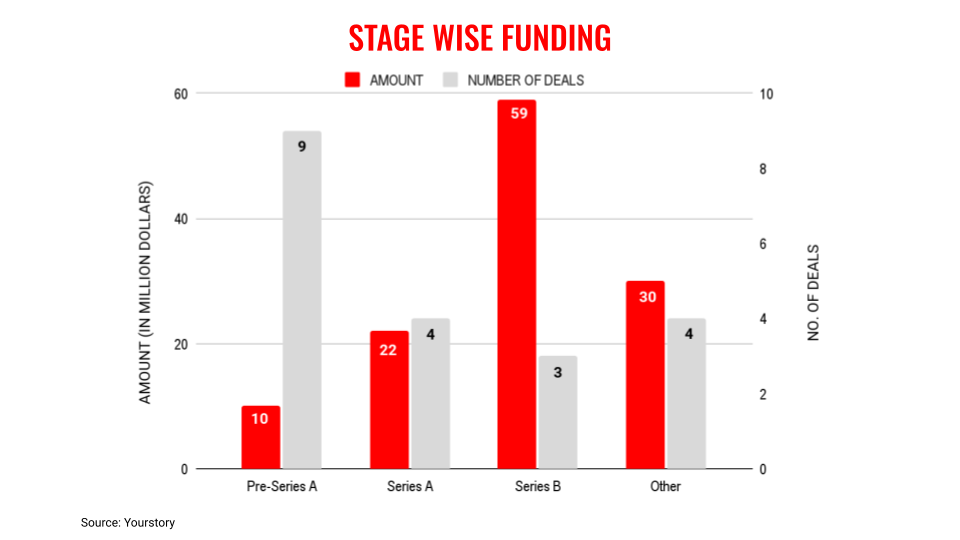

The total funding for the week came in at $122 million across 20 deals. In contrast, the comparable previous week saw an inflow of $306 million. This drop in VC funding is a dampener for the Indian startup ecosystem as it saw a steady increase in the preceding three weeks.

This reveals the challenge the Indian startup ecosystem continues to face in terms of attracting large volumes of capital, primarily due to two factors: the uncertain macroeconomic environment and the absence of any meaningful activity in the AI segment, which is the dominant theme for investors.

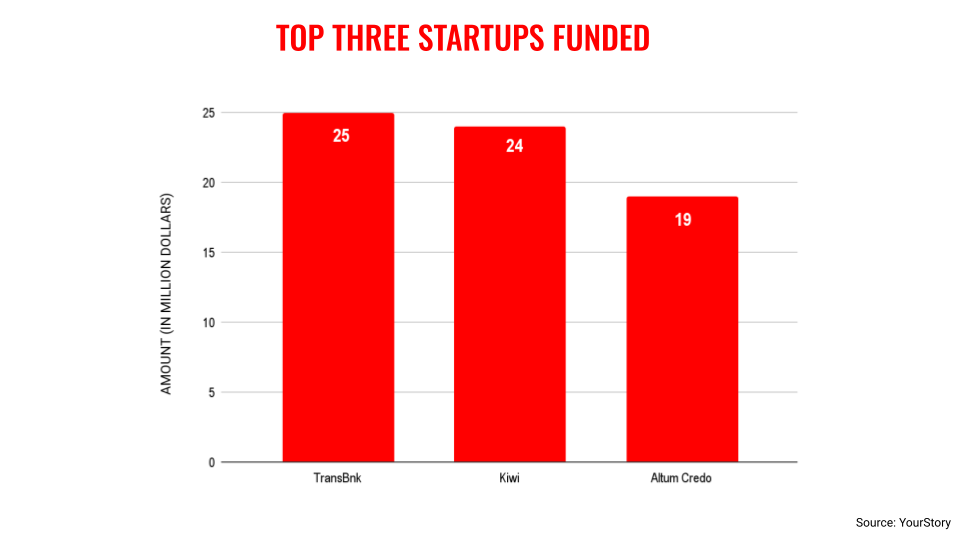

During this week, there was a clear absence of large deals. The highest value transaction was of TransBnk, which raised $25 million. It is the large value deals which provide the momentum to the fund flow. Also, the lower number of deals contributed to less fundraising.

On the other hand, the ecosystem continues to witness interesting developments. Fintech startup Groww has received the nod from SEBI for its IPO, joining the list of companies which are tapping into public markets. Elevation Capital has launched a new $400 million fund to back IPO bound startups.

Key transactions

Fintech startup TransBnk raised $25 million from Bessemer Venture Partners, Arkam Ventures, Fundamentum, 8i Ventures, Accion Venture Labs, and GMO Venture.

Fintech startup Kiwi raised $24 million from Vertex Ventures Southeast Asia & India, Nexus Venture Partners, Stellaris Venture Partners, and Omidyar Network.

Altum Credo Home Finance raised Rs 170 crore ($19.4 million approx.) from British International Investment (BII).

NBFC CredRight raised $10 million from Abler Nordic, Michael & Susan Dell Foundation and Unleash Capital.

Automotive focused startup Vutto raised $7 million from RTP Global and Blume Ventures.

D2C startup Palmonas raised Rs 55 crore ($6.2 million approx.) from Vertex Ventures.

Tech startup Enmovil raised $6 million from Sorin Investments, Capria Ventures and Twynam.

Edited by Jyoti Narayan

Discover more from News Hub

Subscribe to get the latest posts sent to your email.