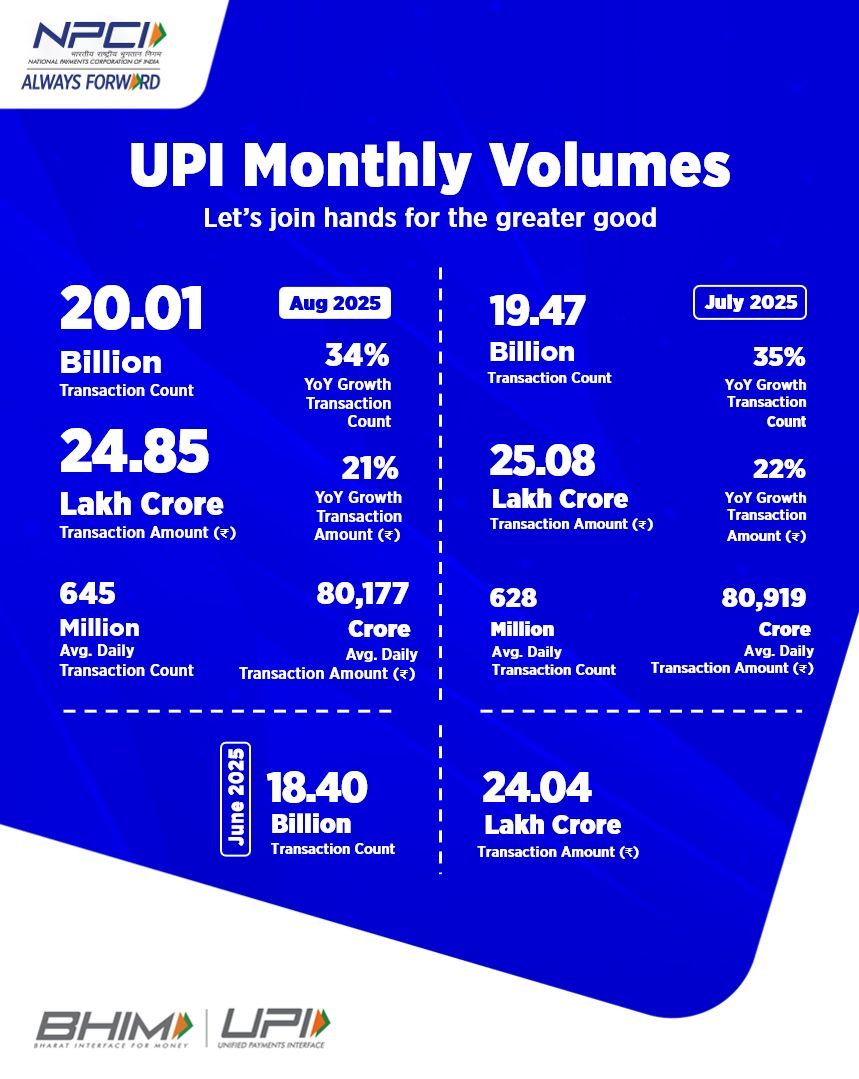

UPI crosses 20 billion monthly payments for the first time

The network handled Rs 24.85 lakh crore in value for the month. Volumes rose 2.8% month on month from 19.47 billion in July, while value eased 0.9% from Rs 25.08 lakh crore.

June 2025 recorded 18.40 billion transactions worth Rs 24.04 lakh crore.

On a year-earlier basis, August volumes grew 34% and value 21%. Average daily activity stood at 645 million transactions totaling Rs 80,177 crore.

The implied average ticket size slipped to nearly Rs 1,243 per transaction in August from approximately Rs 1,420 in July indicating faster growth in small-value payments.

UPI’s breakneck expansion has cooled since crossing 500 million daily transactions in September 2024. TPV growth in H1 2025 was only 40% of H2 2024, and by Q1 FY26, UPI’s value growth (23% YoY) was barely ahead of credit cards (21%) as co-branded cards pull larger-ticket spends, as per The CapTable.

UPI spending on online marketplaces has grown the fastest from April to July this year, outpacing all other retail segments, as more consumers moved to digital platforms.

Spending via UPI on online marketplaces climbed to Rs 8,053.72 crore in July from Rs 5,170.52 crore in April, clocking a 55.76% increase, according to NPCI.

In July, a chunk of payments—about Rs 3.48 lakh crore—went to merchants categorised as ‘Others’, who could not be identified, making it the largest segment by value.

This was followed by debt collection agencies, which clocked high credit repayment via UPI, thanks to the large ticket sizes. Groceries and supermarkets came in next in value terms. Grocery payments via UPI rose 8% to Rs 64,881.98 crore in July from Rs 60,073.81 crore in April.

NPCI, the non-profit umbrella organisation behind UPI, has reported a strong set of numbers for FY25, with both revenue and profitability registering sharp increases.

Operating income rose 18.95% year-on-year to Rs 3,270 crore, up from Rs 2,749 crore in FY2024, according to unaudited and provisional figures disclosed by ratings agency ICRA.

Surplus after tax climbed 41.73% to Rs 1,552 crore, compared to Rs 1,095 crore the year before. NPCI shows a ‘surplus’ instead of profit after tax (PAT) due to NPCI’s not-for-profit corporate structure, which categorises earnings as surplus rather than profit.

Edited by Affirunisa Kankudti

Discover more from News Hub

Subscribe to get the latest posts sent to your email.