In May this year, Snabbit raised $19 million just months after closing its Series A fundraise in January, as it ramps up expansion for its quick home services offering. The latest funding round strengthens its capital base to support a nationwide scale-up.

The company’s board approved the allotment of 54,876 Series C compulsory convertible preference shares (CCPS) at an issue price of Rs 48,377 per share (including a premium of Rs 48,277), valuing the company at Rs 41,236.76 per share on a fully diluted basis, according to the valuation report issued by Sundae Capital Advisors Pvt. Ltd., a SEBI-registered merchant banker and IBBI-registered valuer.

The latest round was led by Bertelsmann Nederland B.V., which invested Rs 135.39 crore, followed by Lightspeed and Elevation Capital, each infusing Rs 53.09 crore, and Nexus Ventures investing Rs 23.89 crore.

The Series C CCPS carry non-cumulative preference dividends at 0.01% per annum and will be convertible into equity shares on a 1:1 basis, subject to standard anti-dilution and corporate event adjustments.

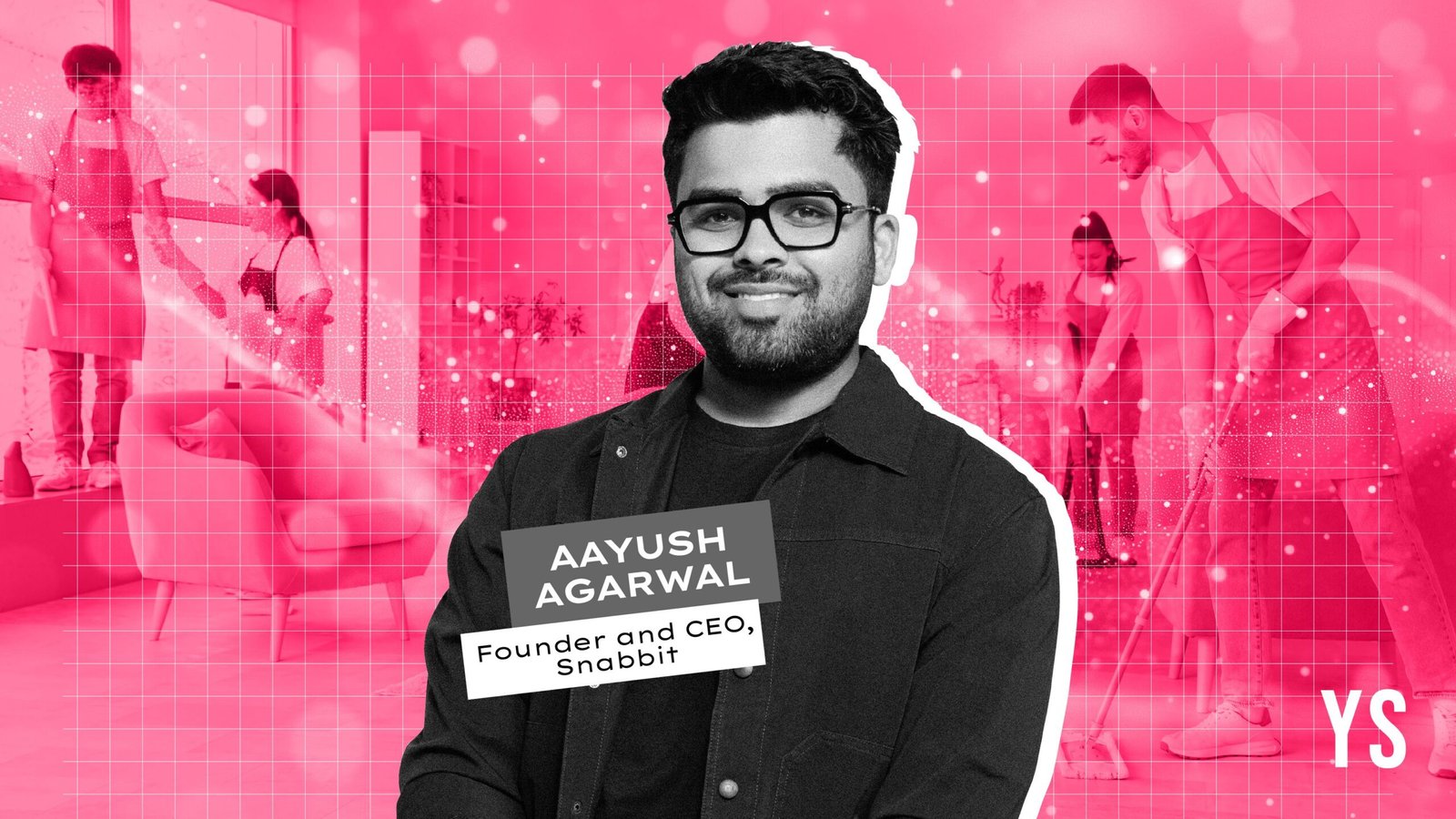

Founded in 2024 by Aayush Agarwal, Snabbit offers 15-minute services in categories such as home cleaning, dish-washing, laundry, and kitchen preparations. Its hyperlocal model selects, trains and deploys technicians within 15 minutes of a user raising a request.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Snabbit recently relocated its base from Mumbai to Bengaluru.

The startup offers partners a minimum guaranteed income—a minimum amount regardless of the inbound service requests. The final payout can increase based on traffic and the number of jobs taken up by the partner.

Edited by Swetha Kannan

Discover more from News Hub

Subscribe to get the latest posts sent to your email.