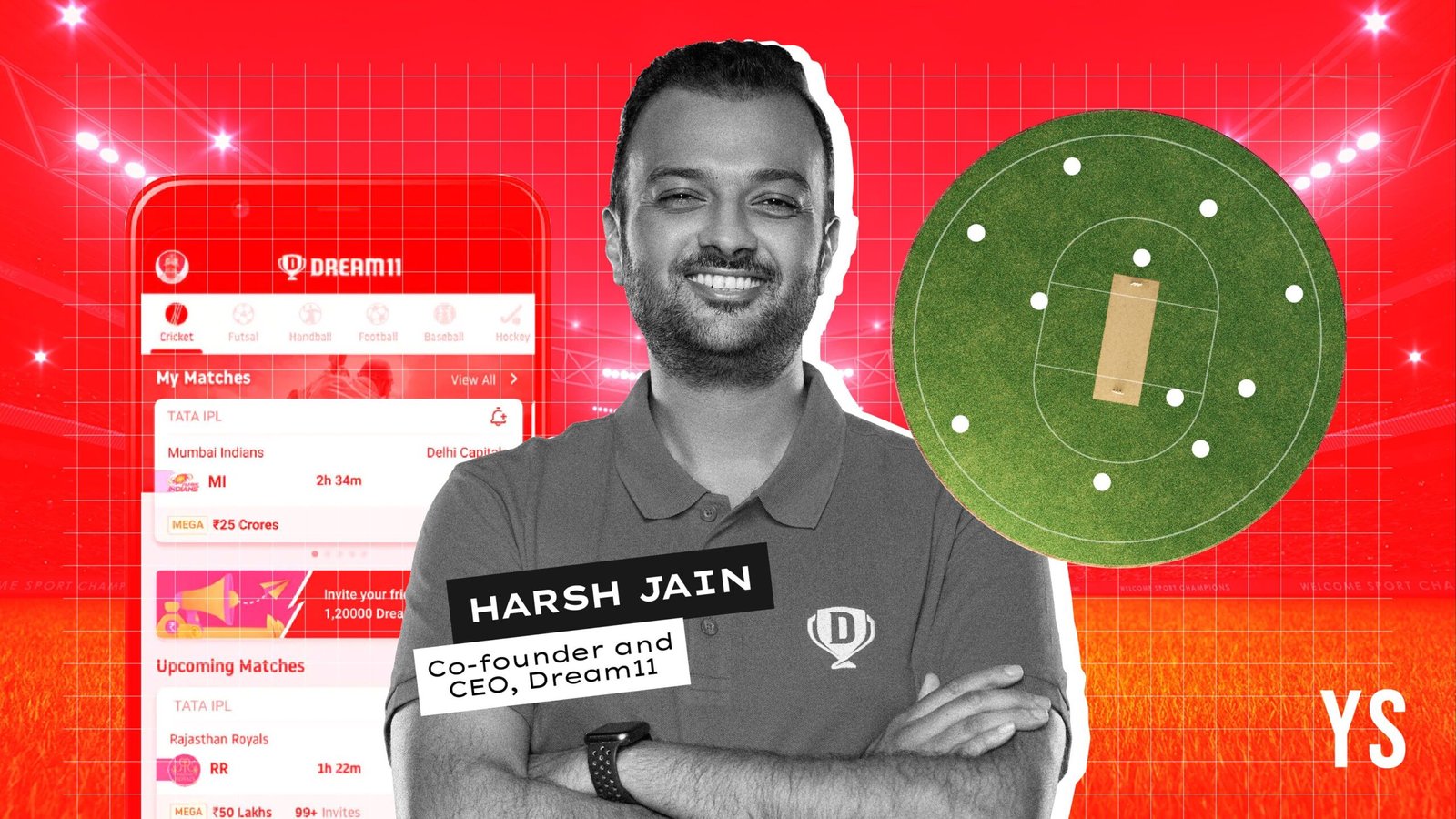

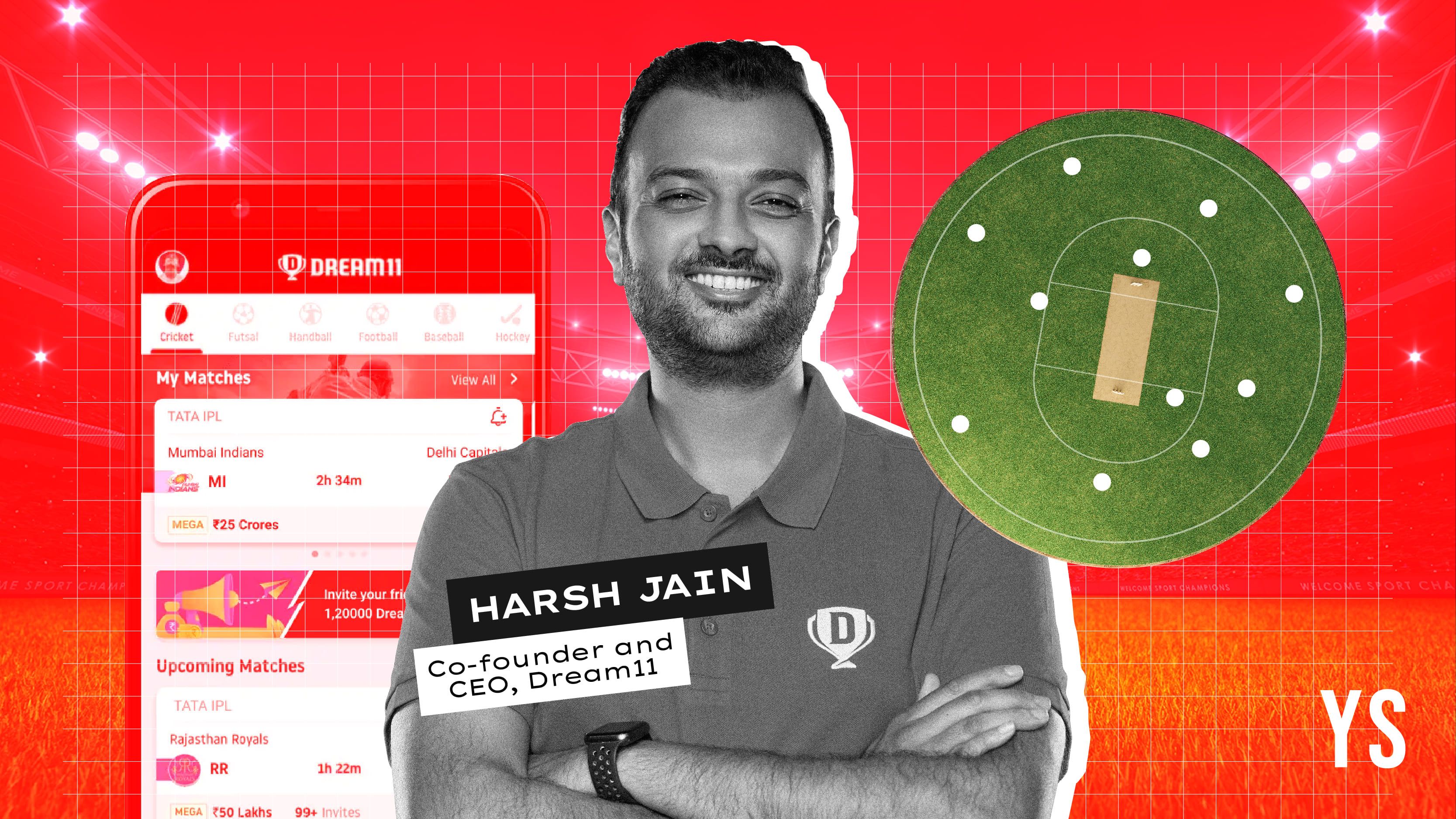

Dream11 loses 95% revenue after gaming ban, says it won’t cut jobs

“Dream11 has always followed and will continue to follow the law — in letter and spirit,” the company said in a statement. “While this change in law has resulted in a loss of approximately 95% of our group’s revenue, we remain committed to building a great Indian sports company, driven by AI and the creator economy.”

The ban, formalised through the Promotion and Regulation of Online Gaming Act, 2025, has upended India’s $2.5 billion real-money gaming sector.

Fantasy sports, rummy, poker and other cash-based games have been forced offline, pushing industry leaders into survival mode. Paytm First Games has shuttered its real-money operations; Gameskraft has halted deposits and gameplay across its rummy platforms, stressing “compliance has always been non-negotiable.” Others like Zupee, MPL and Junglee Games have issued similar shutdown notices.

Dream11’s parent company, Dream Sports, is plotting a pivot. Beyond its flagship fantasy app, the group is shifting attention to its wider portfolio of sports and technology ventures.

Dream11’s parent, Dream Sports, is pivoting beyond its fantasy app to its wider portfolio. FanCode streams sports and sells merchandise, DreamSetGo offers international sports travel, Dream Game Studios develops original titles, and Dream Money will reportedly launch as a personal finance app for gold, fixed deposits, and expense tracking.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Similarly, gaming platform WinZO said it has entered the United States market with its short video content format, following its entry into Brazil in 2023.

In a statement, WinZO said the latest launch puts the company at the intersection of three of the world’s four largest mobile gaming markets—India, Brazil, and the US—with a combined market size of $65–70 billion and more than 20 billion annual mobile game downloads.

Meanwhile, the broader industry is also recalibrating. Earlier this week, major developers and publishers—including Nazara Technologies, Gametion (maker of Ludo King), nCore Games (FAU-G: Domination), and SuperGaming—formed the Indian Game Publishers and Developers Association (IGPDA).

Unlike the fantasy and rummy giants, their focus is on building original, non-cash-based Indian titles that could compete on the global stage.

Edited by Jyoti Narayan

Discover more from News Hub

Subscribe to get the latest posts sent to your email.